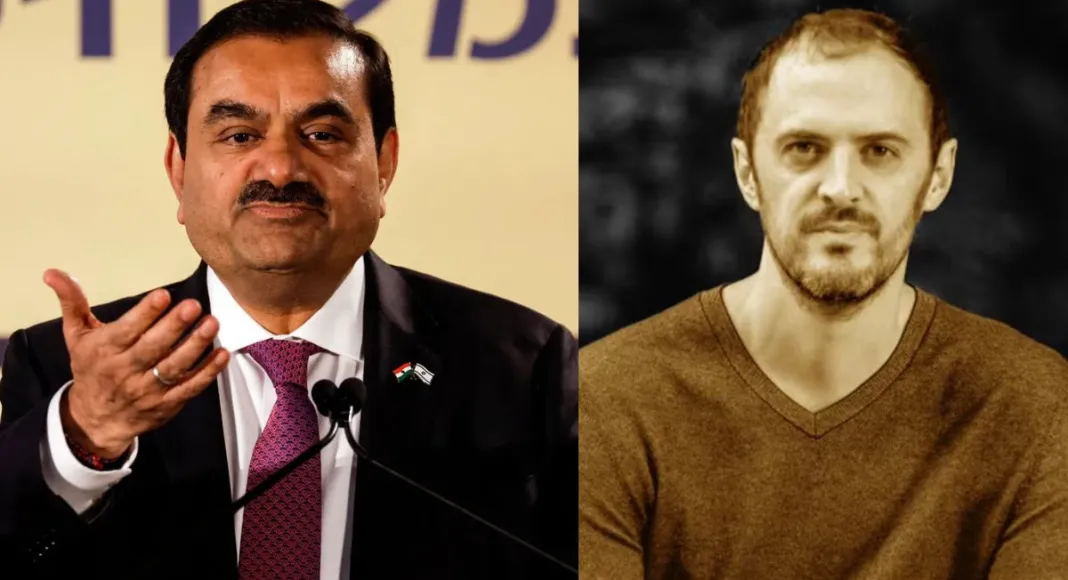

Hindenburg Research, the US-based short-selling firm that caused a global commotion after targeting India’s Adani Group, is reportedly shutting down. This comes at a time when short sellers are shying away from the limelight as legal troubles pile up, including regulatory probes and lawsuits.

Once a formidable player in the financial world, Hindenburg rose to prominence with explosive reports that had an impact on stock markets and corporate reputations. Its report on Adani accused the Indian conglomerate of stock manipulation and accounting fraud, leading to a sharp decline in the group’s market value and global debate over corporate governance.

However, its aggressive approach raised much criticism. The fact that it launched investigations into the activities of short sellers and the increased pressure of operating legally and within strict regulatory parameters makes the environment untenable for companies like Hindenburg.

With the demise of Hindenburg, an era of activist short selling comes to a close. Even though some of its work unmasked uncovered financial impropriety, their methods were portrayed as increasingly disruptive and volatilizing the markets. The financial community remains divided on the legacy of such firms and their role in the global economy.