Introduction

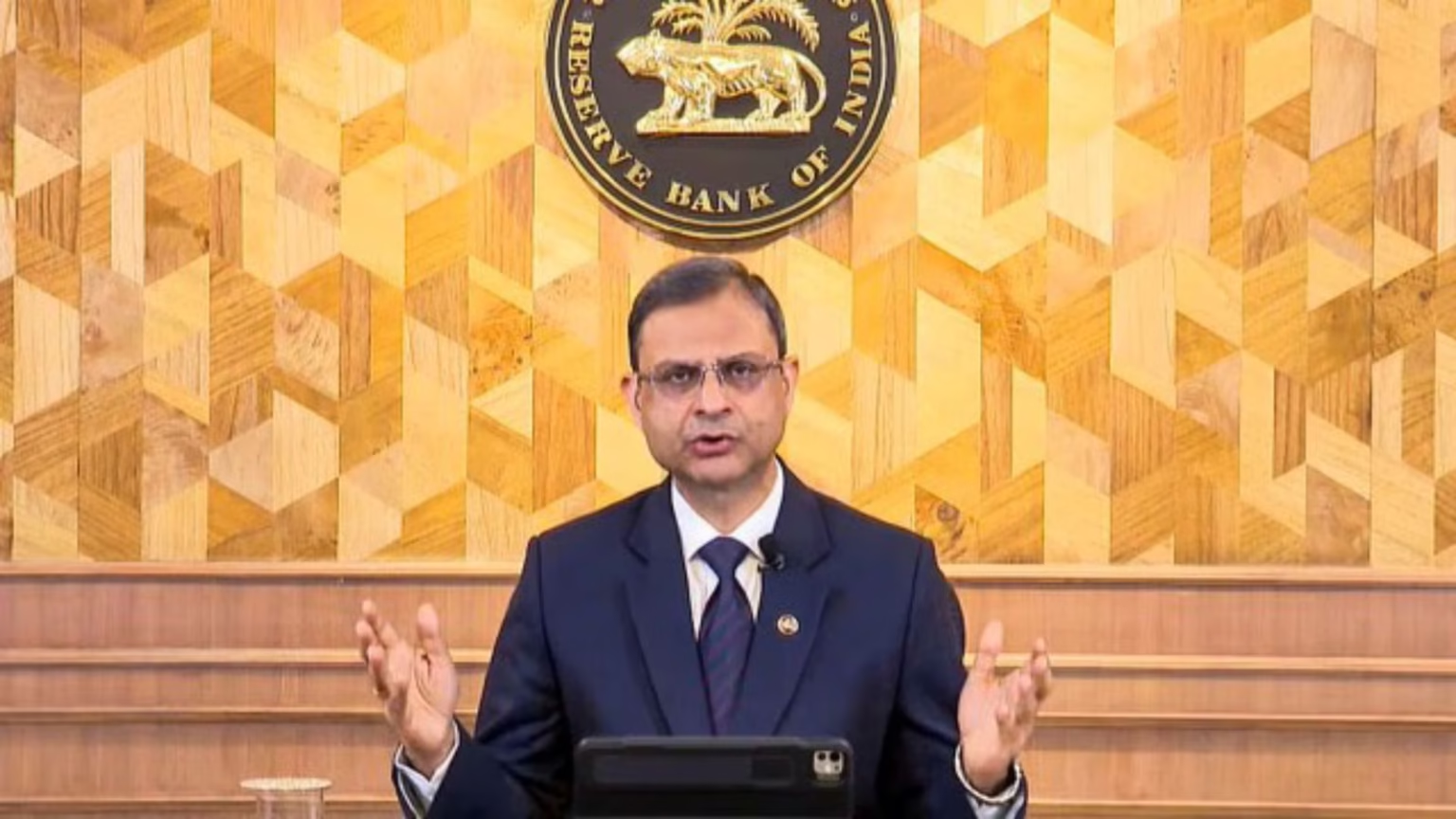

The Reserve Bank of India (RBI) announced a repo rate cut to 5.25%. Officials cited a unanimous decision, reflecting confidence in current economic conditions. The central bank described the situation as ‘goldilocks’—not too hot, not too cold—for the economy. RBI highlighted that inflation remains under control, providing space for monetary easing. Analysts say this move aims to support growth while maintaining price stability. The cut comes as retail borrowers anticipate lower EMIs on home, personal, and auto loans. Banks are expected to adjust interest rates soon, passing benefits to consumers.

Impact on Retail Loan EMIs

The repo rate reduction will directly affect retail loan EMIs. Homeowners and borrowers may see a fall in monthly payments as lending rates decrease. Experts say the move will stimulate consumer spending and boost household financial comfort. Lower EMIs can also encourage new borrowing. It supports sectors like real estate, automobiles, and durable goods. Banks are preparing to recalibrate loan interest rates. The borrowers should check updated rates from their lenders. The rate cut reflects RBI’s strategy to balance growth support with inflation control.

Low Inflation and Economic Stability

RBI emphasized that India’s inflation remains manageable despite global pressures. Core inflation indicators show limited upward trends, giving room for policy easing. The central bank called current conditions “goldilocks,”. It tells about stability in prices and growth. Analysts note that RBI is confident in containing inflation while boosting economic activity. The repo rate cut also shows RBI’s intent to support domestic consumption and investment. Investors and market watchers view the decision as positive for equities and corporate sentiment.

Effect on Banking Sector

Banks and financial institutions will respond quickly to the repo rate reduction. Lending rates, deposit schemes, and short-term credit products may adjust. Analysts predict improved credit flow to businesses and individuals. The RBI’s decision is expected to enhance liquidity in the system. It is helping companies invest in growth. Experts also say that the move strengthens consumer confidence. Both retail and corporate sectors may benefit from cheaper borrowing costs.

Looking Ahead

The RBI plans to monitor economic indicators closely. Further rate adjustments may follow depending on inflation, growth, and global factors. Policymakers are focused on sustainable growth without triggering price instability. Market participants are advised to track RBI announcements for updates. These updates are about lending rates and economic outlook. The central bank’s goldilocks approach is a careful balancing act between growth and maintaining financial stability.