In today’s fast-paced and constantly changing financial markets, investors are always searching for innovative ways to diversify their portfolios and tap into global opportunities. One method that has gained considerable popularity is Contracts for Difference (CFD) trading, with Plus500 leading the charge by providing a platform that merges advanced technology with remarkable flexibility.

CFD Trading: A Smart Investment Strategy for Dynamic Markets

CFD trading enables investors to capitalize on price movements in global financial markets without needing to own the underlying asset. This distinctive feature opens up numerous possibilities, allowing traders to profit from both rising and falling markets—a level of flexibility that traditional investing often lacks. Whether dealing with stocks, commodities, indices, or even cryptocurrencies, CFDs offer exposure to a wide range of markets.

What truly distinguishes CFD trading is its leverage potential. This feature allows traders to enhance their positions, significantly boosting the chances for higher returns. However, while leverage can benefit investors when the market moves favorably, it also introduces greater risk—highlighting the necessity of effective risk management.

Why Plus500 Stands Out in CFD Trading

Plus500 is recognized as one of the most reliable platforms for CFD trading, offering several key benefits that cater to both novice and seasoned traders. Here’s what makes Plus500 a preferred choice for those venturing into the CFD market:

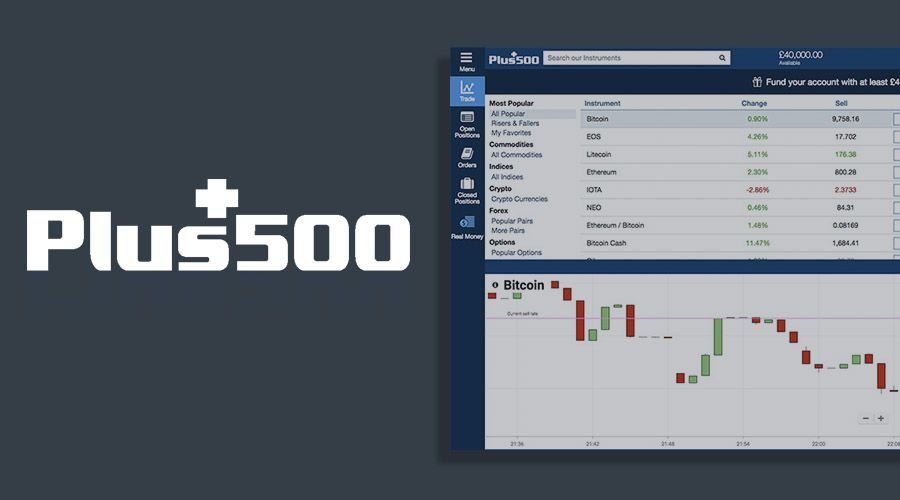

User-Friendly Interface: The platform features an intuitive design that is easy to navigate, making it accessible for beginners. With real-time market data at their fingertips, traders can make quick and informed decisions.

Wide Range of Markets: Plus500 provides access to a diverse array of assets, including stocks, forex, commodities, and cryptocurrencies. This variety allows investors to diversify their portfolios across different sectors and regions.

Leverage and Risk Management Tools: Traders can enhance their potential returns through leverage while utilizing risk management tools like stop-loss and take-profit features. These tools help investors manage their exposure to market volatility effectively.

Regulatory Standards: As a regulated platform, Plus500 prioritizes the protection of investors’ funds and ensures that trading activities adhere to international regulations, offering traders peace of mind.

Competitive Spreads: The platform features tight spreads, allowing traders to enter and exit positions with lower transaction costs, which is crucial for maximizing profits in CFD trading.

New Avenues of Growth with Plus500 CFDs

For those looking for alternative ways to enhance their portfolios, Plus500 serves as an excellent gateway into the CFD market. Unlike traditional investing, which requires ownership of assets, CFDs allow investors to speculate on market trends without the associated ownership costs. This flexibility makes CFDs an attractive option for short-term traders aiming to take advantage of price fluctuations while managing their exposure to various asset classes.

Plus500’s low entry requirements enable investors with limited funds to begin CFD trading while still having the chance for substantial returns. Moreover, Plus500’s sophisticated charting tools and market analysis features equip traders with essential insights to navigate the complexities of global markets.

Is CFD Trading Right for You?

Although CFD trading presents attractive opportunities, it’s important to grasp the risks linked to leverage and market fluctuations. Before getting started, investors should learn how CFDs function, implement risk management strategies, and use demo accounts to gain confidence.

If you want to diversify your trading strategies and take advantage of global market trends, Plus500 is an excellent platform to embark on your CFD trading journey.